id=”article-body” class=”row ” section=”article-body” data-component=”trackCWV”>

Since March 2020, student debt holders have been able to take advantage of the prolonged . The pause on loan payments has already been extended six times — twice by President Donald Trump and four times by President Joe Biden. Now, time is running out, and anxious borrowers want to know if they will have to resume payments on Sept. 1.

Many experts think Biden will announce another extension, potentially through the end of the year or even later. “Our outlook … assumes the federal student-loan payment moratorium will last until January 2023,” Anthony Noto, CEO of student-loan lender SoFi, told investors in an Aug. 2 .

The Department of Education has also told student loan servicers to hold off sending out new billing statements, according to .

Here’s what you need to know about federal student loan payments, including how long the pause could last, what other benefits it includes and whether Biden will push for more student debt forgiveness.

Three clues student loan payments might be paused again

President Biden has not indicated yet whether he will pause student debt payments again, but there are several indications he might.

1. Inflation is still a major problem

While the country has turned a corner on the coronavirus pandemic, the White House has repeatedly said decisions about pausing student loans would be driven by what’s happening with the economy. While , food, housing and other essential services are still sky high. On Aug. 10, grocery prices were up 13.1% year over year — that’s the largest increase since March 1979, .And economists still portend .

“Excessive inflation has increased prices for almost everything and most borrowers are likely not in a position to pay off their loans,” Tony Aguilar, CEO of student loan repayment app Chipper told CNET’s sister site, . “An additional extension also provides the White House with more time to review potential forgiveness plans.”

2. Lenders were told to postpone contacting borrowers

“The situation is that we’re almost 30 days away from the planned resumption and the [Department of Education] has been telling servicers to hold off on resumption communications for the last few months,” Scott Buchanan, executive director of the nonprofit Student Loan Servicing Alliance, on July 25. “Maybe the department expects that the White House will yet again kick the can down the road.”

Zack Friedman, 클레오카지노주소 CEO of online financial marketplace Mentor, that, in theory, “Biden could continue to extend student loan relief through multiple executive orders, creating a student loan payment pause ‘forever.'” Or at least until he leaves office.

3. Another extension may woo young voters in the midterm elections

Despite improving job numbers and the declining price of gas, Biden’s approval ratings have not been great as the midterm elections approach. On Aug. 9, 55% of Americans disapproved of the president, .Throwing a bone to the more than 40 million Americans with federal student loans could help boost Democrats’ appeal come Nov. 8.

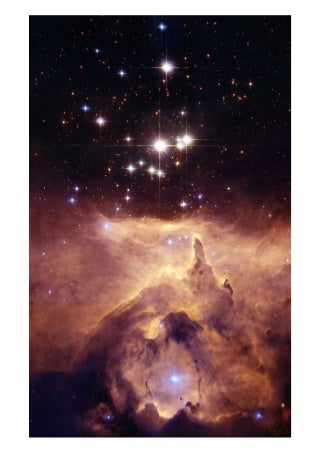

With just weeks until student loan payments are set to resume, the Department of Education has told servicers not to send new billing statements.

Peter Dazeley/Getty Images

What happens to borrowers who are in default?

Federal student debt repayments have been paused for more than two years, meaning interest hasn’t accumulated and collections on defaulted debts have been put on hold.

Borrowers in default will automatically be given a “fresh start,” according to a statement from the . Their accounts will be returned to good standing and any delinquency will be “cured,” allowing them to repair their credit and gain access to programs like income-driven repayment and , 클레오카지노주소 which benefits those who work for nonprofits.

“During the pause, we will continue our preparations to give borrowers a fresh start and to ensure that all borrowers have access to repayment plans that meet their financial situations and needs,” Miguel Cardona, the education secretary, said in a statement.

Will more student debt be forgiven?

On the campaign trail, Biden said he’d support legislation canceling a minimum of $10,000 of federal loans per borrower. Democratic lawmakers would like to see that amount upped to $50,000, 카지노사이트 Bloomberg reported, in hopes of swaying young voters in November.

If he does forgive more student debt, Biden would likely cap eligibility at individuals earning $125,000 or $150,000 a year.

Republicans in Congress have argued the president doesn’t have the authority to cancel billions in student debt and

But there are signs the White House sees it differently: Following the Department of Education’s revamp of its Public Service Loan Forgiveness program in October 2021, more than 750,000 borrowers have had their student loans extinguished, as of May 2022.

In 2019, Harvard Law School’s Project on Predatory Student Lending against then-Secretary of Education Betsy DeVos, claiming her office had stalled applications for the program, which allows federal student loan debt to be canceled if the borrower was defrauded by their school.

The Biden administration in July agreed with the plaintiff’s arguments that the Secretary of Education has “considerable discretion” to cancel federal student loan debt, . (This month a federal judge granted preliminary approval that would give some 200,000 defrauded borrowers around $6 billion in debt relief.)

Whatever Biden decides about more student debt forgiveness, borrowers and financial institutions alike are eager to hear it. At an April 28 , the president said he’d make a decision on “in the next couple of weeks.”

That was nearly three months ago.

Leave A Comment